Markets - Uruguay - BEVSA - CUD

Published byalphacastinBolsa Electrónica de Valores del Uruguay (BEVSA)

Last update 5 hours ago

Dataset Information

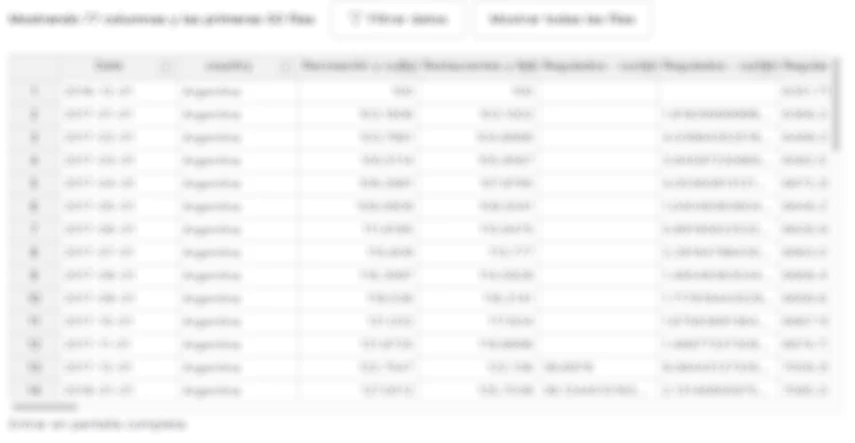

Data available from 2003-01-10 to 2025-04-29- Source: BEVSA

This dataset includes daily information on the Yield Spot Curve of Uruguayan Sovereign Securities issued in United States dollars. The methodology applied for the construction of the CUD curve is based on the method called “Constant Forward Spreads”. The curve shows the term structure of interest rates of Uruguayan sovereign debt issued in dollars United States. It allows generating reasonable valuations (fair-value), estimating volatilities and correlations for an adequate caliber of market int...

Access all the content on Alphacast

Create a free account to access more than 4,500 datasets from over 350 sources, structured and ready to use.