[DISCONTINUED] Fiscal & Dbet - Brazil - STN - Central Government - Primary & Fiscal Result - Yearly

Published byalphacastinAlphacast Discontinued

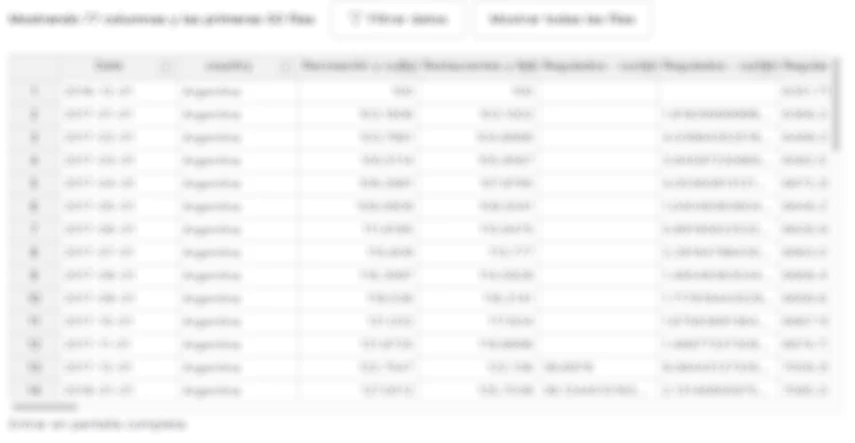

Created with pipeline Fiscal - Brazil - STN - Primary and Fiscal Result of the Central Government - Annual

Last update 2024-03-20

Dataset Information

Data available from 1997-01-01 to 2024-01-01- Source: STN

Note 1: Total revenue is calculated using the cash concept, which corresponds to the effective entry into the Single Account (Conta Única). Note 2: Transfers by revenue breakdown and Total expenditure are determined by the concept of effective payment', which corresponds to the value of the withdrawal made in the Single Account. As of March 1, 2012, it includes resources to supplement the FGTS and expenses incurred with resources from this contribution (as provided for in Ordinance STN nº 278, of 19/04/2012)....

Access all the content on Alphacast

Create a free account to access more than 4,500 datasets from over 350 sources, structured and ready to use.