Markets - Ecuador - BVQ - Ecuador Stock Exchange Indexes

Published byalphacastinBolsa de Valores Quito (BVQ)

Last update 5 hours ago

Dataset Information

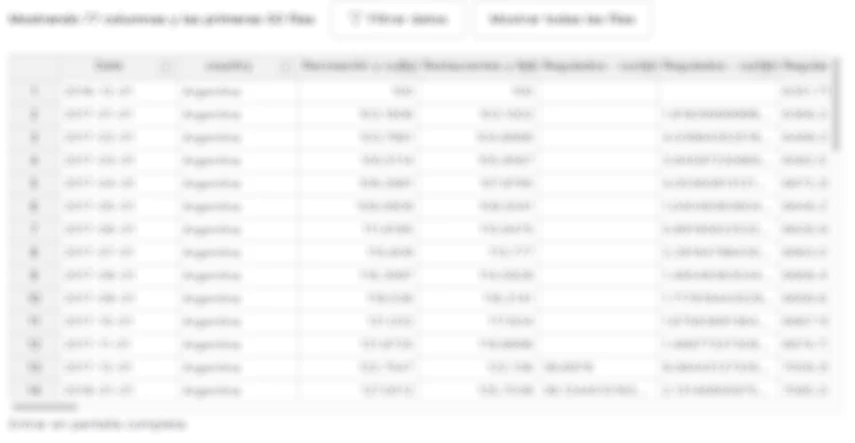

Data available from 2019-01-02 to 2025-04-29- Source: BVQ

This dataset includes the Ecuador Stock Exchange Indexes. If the variation of the Ecuindex is equal to 0%, it means that the stock prices are unchanged from the previous day's prices. If the variation of the Ecuindex is greater (less) than 0, the stock prices show a positive (negative) trend with respect to the previous day's prices. The base for this indicator is 100 points (1993-08-02). The IVQ (Quito Volume Index) is the Stock Market Index that reflects the ratio of the total amount traded in...

Access all the content on Alphacast

Create a free account to access more than 4,500 datasets from over 350 sources, structured and ready to use.