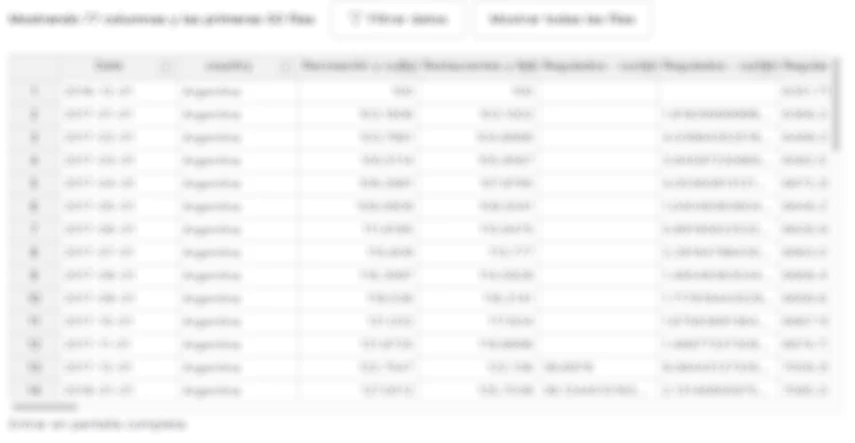

Monetary - Brazil - BCB - International Reserves - Monthly

Published byalphacastinBanco Central do Brasil (BCB)

Last update 2025-02-08

Dataset Information

Data available from 1970-12-01 to 2025-01-01- Source: BCB

This dataset contains monthly information on the International reserves produced by the Central Bank of Brazil. data are in USD Millions. International reserves comprise the country's readily available foreign assets held by the Central Bank of Brazil for the purpose of financing any balance of payments deficits. he time series present the following components of foreign assets in the liquidity' concept, made available monthly from January 2000:

Reserves in convertible currencies - total - represents the sum of assets invested in bonds and in the form of time deposits....

Access all the content on Alphacast

Create a free account to access more than 4,500 datasets from over 350 sources, structured and ready to use.